Student Property Report 2009-2010

14th December 2009

In a market where many investors have seen rental voids, capital values decrease and Ltv rates decrease, why are many of the UK’s most renowned investors focusing on Student Accommodation?

In a market where many investors have seen rental voids, capital values decrease and Ltv rates decrease, why are many of the UK’s most renowned investors focusing on Student Accommodation?

If you look at the simple economics, student accommodation really does sell itself.

In short, you can purchase a property that will rent at a much higher value to students than an equivalent unit would to a private individual. You also do not have the downfall of rental voids! In fact, many landlords are filling their units 6 months in advance!

Many investors want hands off investments with high returns and no rental voids.

If this is you, look no further.

Demand:

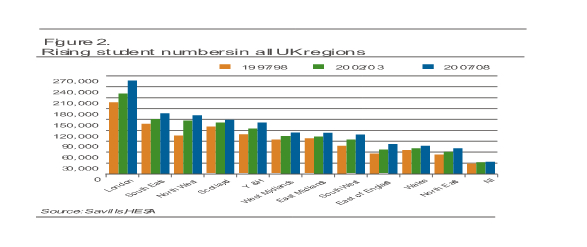

Where rental demand in the residential sector is prone to peaks and troughs, student number have continued to rise from 1.8 million in 1996-97 to approaching 2.4 million in 2009-10*.

Indeed early indications are that the economic conditions have led to even more people looking to higher education.

UCAS data revealed that UK university applicants rose 10% between 2008 and 2009 and overseas applicants rose 13.6% during the same period.

“Overall student numbers are likely to remain stable and in the medium-term there is unlikely to be a substantial uplift in student places as caps remain in place. However, the expectation is that the proportions of both overseas and postgraduate students will continue to grow, underpinning future demand for private professionally managed halls.” Knight Frank

Supply:

Private Student Development is still made up of the 4 main service providers, UNITE, UPP, Opal and Liberty Living. The majority of students have to rely on halls for their accommodation with a small percent benefitting from access to private operated rooms.

Many university run halls are found to be outdated and lacking in necessary facilities. This creates demand for private accommodation but with development finance so hard to come by, this accommodation is nowhere near keeping up with demand.

“Student Numbers are growing at 15 times the rate of new supply in London” Savills

Prospects:

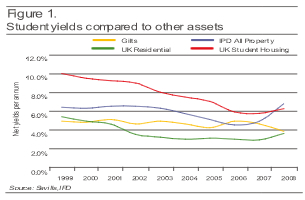

Student accommodation rents have increased by 5% p.a for the last 6 years with growth increasing right into the 2009/10 academic years. Compare this to residential and commercial rents which have both fallen overall during this period and you start to understand what makes this market so appealing.

“Student Housing delivers income during uncertain economic times” Savills

As student accommodation is commercial by class this has also seen an increase in values, this sectors robustness is highly attractive to a growing number of investors who want high capital growth that can be depended on for the long term.

Even in the midst of a global downturn occupation levels for good quality purpose built private accommodation is close to 100% with rental levels for 2010 predicted to increase by at least 5%.

Yields and Values:

Although the rentals gained have not been hit by the credit crunch, one side that has been impacted has been the finance student developers have been able to find. Because of a lack of this many new build schemes have not got off the ground.

If we factor this and the fact that university applications have steadily increased we have a demand/supply scenario which is drastically in the favour of the buy to let investor with student property in their portfolio.

Compound this with the fact that many universities cannot afford to build the necessary accommodation themselves and we have a scenario where these same universities cannot grow to their potential because of this lack of accommodation.

Universities have always relied on private developers to make up the deficit that their own student halls cannot fill.

With many student developers not building because of the lending constrictions, small investors are starting to fill the void with new build 4/5 bedroom houses. These normally comply with the rigorous build accreditations and rent for a lot more than residential lettings.

Through this lack of supply yields have risen steadily and values have followed, we envision this to be the case for the foreseeable future. The student market is continually growing and with many universities operating on shoestrings it falls to the private student developers to build in their place.

How we can help:

You will have seen by previous posts, blogs and emails that Fresh Invest have faith in the student market as a valid buy to let option.

For this reason we are due in the very near future to bring you a selection of landmark student investments which can be bought as “completely hands off” investments.

These properties will come already tenanted with high yields and great commercial mortgage options.

Register your interest for these opportunities here.

Back to news