HMO London SE12

More Information

The Details:

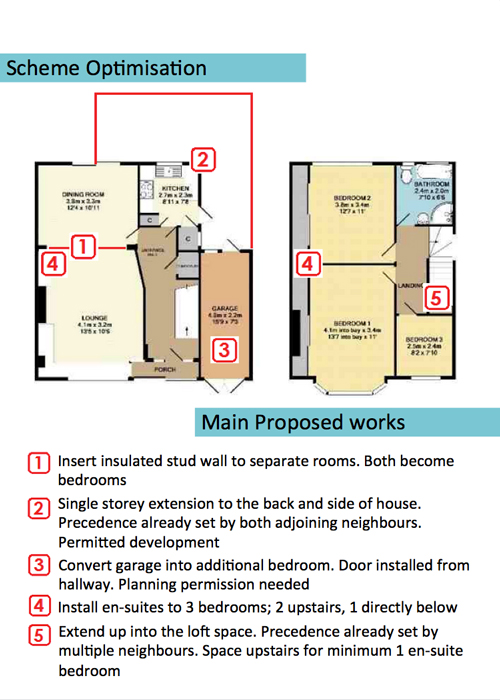

This 3 bedroomed residential house has the potential to become a 7 bed HMO by extending backwards and converting both the loft and current garage. This produces a huge 7% Net yield on cash invested, in an area of London with huge potential for future capital growth.

The current property consists of:

- 3 double bedrooms

- 1 large family bathroom

- 2 reception rooms (through lounge)

- Kitchen

- Garage

- Huge Garden

Figures:

- Purchase Price – £525,000

- Cash Investment inc Refurbishment – £255,955

- Monthly Net Profit – £1,496

Area and Location:

This house is within a 5 minute walk from Lee overground station in zone 3 of South East London. Lee goes directly into London Bridge within 14 – 21 minutes (depending on which train you catch).

This makes it an ideal location for professional sharers working in the city. It is 20 minutes walk from the ever-popular Blackheath common and has a large Sainsbury’s within walking distance as well. In addition there are a number of local amenities including restaurants, corner shops and pubs within 5 minutes of the house.